Contents

Report 16 of the 14 June 2010 meeting of the Corporate Governance Committee, with a summary of the development of the MPA risk management process.

- MPS corporate governance framework update

- Summary

- A. Recommendation

- B. Supporting information

- C. Race and equality impact

- D. Financial implications

- E. Legal implications

- F. Background papers

- G. Contact details

- Appendix 1 - The MPS corporate governance model

- Appendix 2 - MPS corporate governance work streams

- Appendix 3 - update on business charge card

Warning: This is archived material and may be out of date. The Metropolitan Police Authority has been replaced by the Mayor's Office for Policing and Crime (MOPC).

See the MOPC website for further information.

MPS corporate governance framework update

Report: 16

Date: 14 June 2010

By: Director of Resources on behalf of the Commissioner

Summary

This report provides a progress update on the Metropolitan Police Service (MPS) Corporate Governance Framework.

A. Recommendation

That: Members note the progress being made across a number of areas of corporate governance.

B. Supporting information

Current corporate governance arrangements

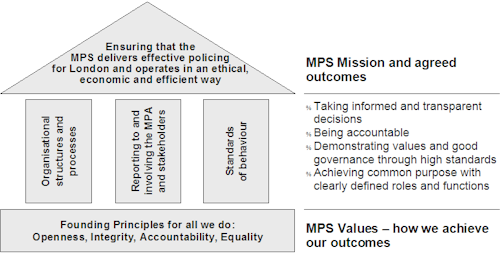

1. The MPS continues its drive to achieve excellence in corporate governance. It uses an established ‘temple’ model of corporate governance, approved by Management Board (see Appendix 1) that reflects current good practice.

2. The MPS corporate governance work programme consists of a number of work streams that have been identified through a gap analysis against elements of the CIPFA/SOLACE framework: “Delivering Good Governance in Local Government” the Interim Guidance Note for Police Authorities & Forces in England and Wales (2007) and significant governance issues included the 2008/09 MPS Annual Assurance Statement. A full list of work streams and the responsible leads is included in Appendix 2. This work programme is managed and monitored through the MPS Governance Board with regular progress updates to this Committee.

3. The 2009/10 Annual Assurance Statement has now been written on behalf of the Commissioner and was approved by Management Board and forwarded to the MPA in May. The next quarterly corporate governance report which will be submitted to September’s MPA Corporate Governance Committee will include updates on a refreshed set of work streams which will reflect the areas identified in the 2009/10 Annual Assurance Statement for improvement in 2010/11.

Progress update

Summary of progress

4. For each work stream, a progress update for quarter 4 is detailed below.

Pillar One: Organisational structures & processes

5. Embedding risk management

- The DoR assessment against the MPS risk maturity model has now been carried out which completes the maturity model pilot. Strengths and weaknesses around the model have been identified and amendments will be made to the areas of weakness before moving on to the assessment of DoI.

- The Risk Manager’s Together forum terms of reference have been reviewed and the structure of the group changed to an information sharing forum for risk specialists and business group risk co-ordinators which will meet every six months.

- The structure of the risk management intranet site has been updated.

- A briefing to the MPA Corporate Governance Committee members took place on 13th May. The briefing covered MPS risk management processes, the MPS corporate risk register and included a substantial question and answer session. Members felt that the session was useful in improving their understanding of MPS risk processes and have requested for the session to be repeated for absent members.

6. Implementation of Developing Resource Management Programme.

Development and implementation of the DRM2 workstreams has progressed as follows:

7. Corporate Real Estate (CRE)

- Following agreement of the Corporate Real Estate principles by Governance Board in February, work is progressing on the development of this workstream. Given the increasing financial constraints the project is being challenged to accelerate delivery.

- Principles for the ‘office’ strand were agreed by Governance Board in May and best practice visits have been organised.

- Cost data is close to completion.

8. Development of SAP

- The Fixed Asset Patch has been delivered in time to enable end-of-year accounts to be on-system.

- Scoping and due diligence of the Asset Tracking project has continued, with the business case on schedule to be agreed by the end of May.

- The Capital Management and Invoice Management projects are both on track for delivery in July and December 2010 respectively. Both projects have engaged stakeholders, developed and implemented project plans and held design workshops including early system demonstrations. Due to changes to the scope of training requirements, elements of the training / roll out for Capital Management may be rescheduled to September 2010.

- The tender for external support to the Capability Review was sent out in April. The evaluation framework and process is now being developed. The project is on track to have consultants onsite between September and December 2010.

9. DRM2 Procurement Services

- Following a competitive process, Capgemini were appointed to provide external support to this workstream. Following early engagement, the team started onsite in May, with a 20 week plan for delivery. The project initiation document has been agreed and a statement of work is in development.

10. Finance and Resources Modernisation (second wave) (F&R2)

- Following extensive discussion at DRM Steering Group in February, the business case for F&R2 has been redeveloped with stakeholders and a revised business case is due to be agreed by DRM Steering Group in May and discussed at Governance Board in June.

11. Partnerships

- The Partnership work stream has been working closely with key stakeholders across the MPS, MPA and Government Office for London, to progress this workstream.

- A Head of Partnerships has been appointed and is in post.

- A map of the pan -London partnership landscape and MPS representation has been produced.

- The Partnership toolkit has been reviewed and updated as required.

- Initial analysis of partnership risk has been conducted.

12. Provision of detailed information on emerging market hotspots, especially around specialisms and specialist professionals

- Agreement has been reached with the trade unions on greater flexibility on starting salaries for a group of defined roles in DoI and roles will be advertised with a wider salary range (i.e. base +3 spinal points).

- Seven ‘spot rate’ positions are under recruitment. Of these, 4 roles are under offer with the other 3 roles currently at interview stage.

- A review of relevant market rates using available salary surveys and intelligence from recruitment / agency contacts is on-going.

13. Review of expenses policy

- The new expenses guidance is ready for joint publication on Finance and HR intranet sites. A revised policy statement is in draft.

14. Management Board operating framework & scheme of delegation

- A robust audit trail of delegation from Management Board to Finance, Procurement and Property Schemes of Delegation is being created.

- Validation is taking place to ensure that the emerging scheme of delegation takes account of statutory and non-statutory functions carried out or delegated by the MPA, whether laid out in legislation or standing orders.

15. Performance against business groups business plans

- Work continues to develop the Monthly Management Report (MMR) process for assessing progress against the measures in the Business Group Business Plans.

- The first Quarterly Management Report (QMR) for 2010/11, presented in the format of the period 9 report, will go to Management Board in July.

16. Organisational learning

- The MPS lead on Organisational Learning has been selected and is now in post.

- Consultation is ongoing to identify the important work which is taking place across the MPS. This will shape a corporate, performance driven approach to learning as well as a more proactive approach to identifying and sharing learning as part of normal working practice.

- When the detail of the framework at all levels is finalised, further work will need to be carried out, in consultation with strategic partners, to formulate a communication strategy. This will enable key stakeholders to understand what the MPS is committed to achieving and, internally, act as a catalyst for the cultural shift towards a more effective learning environment.

17. Compliance framework (previously Non- Compliance framework.)

- A number of initiatives are being developed to improve awareness of compliance. These primarily relate to the induction process where the compliance message is to be incorporated into the forthcoming corporate welcome pack for all new starters prior to joining, as well as inclusion in new starter induction days.

- DoI have also implemented a series of improvements with Capgemini in respect of charging and recording of IT assets.

18. Review of MPS Environment Strategy and development of Corporate Social Responsibility (CSR) / Sustainable Development Strategy for 2010-13

- The MPS has incorporated targets for waste reduction, reuse and recycling into procurement documentation for construction programmes to ensure suppliers assist in meeting the MPS commitment to halving construction waste to landfill by 2012.

- Facilities Management Suppliers have submitted a draft Sustainable Waste Management Plan to the MPS which include targets to recycle 45% by the end of 2010.

- New recycling targets past 2010 have been developed as part of the Environmental Management Programme during May. This forms part of the MPS CSR strategy development process.

- Work continues to collate and verify the environmental performance data for 2009/10 as well as carry out a review of the MPS 5 year Environmental Strategy.

- A new Environmental Management Programme is currently being developed through consultation with key MPS stakeholders to deliver the new environmental objectives in the CSR Strategy 2010 - 2013.

- Following the provision of information to support the Use of Natural Resources section of the PURE audit, further information has been submitted to address areas of clarification required by the Audit Commission.

- Work continues across the CSR programmes, with primary focus upon finalising the CSR Strategy for consideration by Management Board on 16 June 2010 and MPA Finance &Resource (F&R) Committee in July.

- The MPS continues to evaluate the savings achieved through the pilot Building Energy Efficiency Programme (BEEP) projects as well as identifying lessons learned before deciding on a strategy for future work. An options paper is currently being finalised which will set out a recommended approach to ensuring Value for Money energy / carbon reduction measures.

- As from the 1st April 2010, the MPS is now participating in the mandatory Carbon Reduction Commitment Energy Efficiency Scheme. Work will be progressed to deliver the early action metrics which are a requirement of the scheme.

- The environmental awareness campaign programme is currently at mobilisation stage and will be piloted at two MPS sites to enable a range of measures to be implemented as well as a verification of savings. This will include road shows, recruitment of a network of champions as well as focused key messages to encourage a change in behaviour.

19. Service Improvement Plan (SIP)

- The financial position, high level milestones and project status for each SIP project was presented to Governance Board in March. The current status of all the SIP projects continue to be monitored to ensure they contribute towards closing the current budget gap for years 2011/12 and 2012/13.

20. Business charge card

- Barclaycards were introduced as the new business charge card in May 2008, with tighter criteria for the cardholder to account for their expenditure (within 30 days). See Appendix 3 for the value of items of Barclaycard expenditure as at 21st May 2010 and a full update on the current progress and controls in place to manage this process.

Pillar Two: Reporting to & involving the MPA & stakeholders

21. Review of all forms of public engagement and consultation

- A consultation version of the joint MPA/MPS Community Engagement Strategy has been developed and circulated to a wide range of groups and stakeholders across London. The strategy has been revised in the light of feedback and will be called the MPA/MPS Community Engagement Commitment. This is built around six key principles which describe how the MPA/MPS engage and how the approach to community engagement will be improved.

- The draft Commitment is being presented to the MPA Community Engagement Project Committee in May and also to Management Board for consideration.

Safer Neighbourhoods panel training and business / youth engagement

22. Panel Training

- Panel training will be concluded this summer. The final evaluation and report is being conducted and will be submitted to project partners in July.

23. Business Engagement

- Business engagement across the service is being reviewed in order to identify good practice and areas for improvement. This will result in the development of a corporate approach to business engagement and business engagement strategies.

24. Youth Engagement

- The Youth Survey for 2010 has now been completed. A full evaluation process will now take place and a report written which will include identified improvements and good practice from the latest round of surveys to take forward to the next Youth Survey in 2011.

Pillar Three: Standards of behaviour

25. Enhanced MPA/MPS Fraud and Corruption Awareness Strategy

- Following receipt of the Audit Commission’s final report on Raising Fraud Awareness, an action plan has been developed to implement the agreed recommendations.

- The MPA Fraud Prevention Officer and MPS Finance Services are working together to make links between fraud awareness and the compliance framework to give managers greater confidence to take decisive action and improve professional standards and increase opportunities to prevent fraud in the first instance.

- As part of the compliance framework, as detailed in paragraph 17, it has been agreed that a robust fraud message will be incorporated into the forthcoming HR welcome pack for all new starters prior to joining and will also be included in the new corporate induction day for all officers and staff.

26. Introducing the Equality Standard

- Following the first diversity practitioners network meeting in January, the Diversity Partners Forum met in April to further communicate and integrate the Diversity and Equality Strategy and Equality Standards for the Police Service (ESPS) into MPS activity.

- Email communications have been sent to all (B)OCUs setting out both the expectations on them and the benefits of the ESPS. There was also a corporate intranet article launching the ESPS ‘go live’ date on the 19th April 2010.

- It has been agreed that in the interests of efficiency and effectiveness the ESPS will be phased in across the MPS. TP will be the main focus for the first phase and meetings have taken place with TP Boroughs to conduct familiarising sessions and assist in the completion of equality & diversity workbooks. A helpline has been set up in support of this.

Environmental implications

27. The work streams identified have varying levels of environmental impact / benefits.

C. Race and equality impact

The model of corporate governance set out in this report is based on the principles of openness; integrity; accountability and equality. The development of the framework therefore should have a positive race and diversity impact by ensuring that these principles inform the way in which MPS operates. Furthermore, improved communication of the corporate governance framework aims to help staff understand how to apply these principles in their day-to-day work.

D. Financial implications

All costs relating to the above activities are covered from within existing MPS budgets.

E. Legal implications

1. The MPA are under a statutory duty to prepare and publish an Annual Governance Statement (AGS), under regulation 4 (2) of the Accounts & Audit Regulations 2003, as amended by the Accounts & Audit (Amendment) (England) Regulations 2006. The AGS is a general certification about governance issues, which is the primary responsibility of the MPA as police authority.

2. In order that the MPA can discharge its statutory duty referred to in paragraph 1 above, the MPS provides its certification to the MPA by submitting an Annual Assurance Statement (AAS), as recommended by CIPFA / SOLACE guidance “Delivering Good Governance in Local Government-Interim Guidance Note for Police Authorities and Forces in England and Wales (2007”) (“The Guidance”), which demonstrates how aspects of governance have been implemented within the police force.

3. The Corporate Governance Framework provides the supporting information which evidences that the MPS will ensure it has robust systems in place that demonstrate it is adhering to the strategic direction set by the MPA, and is delivering good governance through the delivery of many operational and financial aspects within a delegated framework, in accordance with Guidance and best practice.

4. Compliance with the Corporate Framework will also assist in raising standards, reduce risk of legal challenge and build public confidence by ensuring the MPS operates in a transparent manner.

F. Background papers

- Appendix 1 - The MPS Corporate Governance Model

- Appendix 2 - MPS Corporate Governance Work Streams

- Appendix 3 - Update on Business Charge Card

G. Contact details

Report author: Sian Hartley

For information contact:

MPA general: 020 7202 0202

Media enquiries: 020 7202 0217/18

Appendix 1 - The MPS corporate governance model

Appendix 2 - MPS corporate governance work streams

| Work stream | Lead |

|---|---|

| Pillar One: Organisational structures & processes | |

| Embedding risk management * | Director of Business Performance |

| Implementation of Developing Resource Management Programme * | Director of Resources |

| Partnerships * | Director of Resources |

| Provision of detailed information on emerging market hotspots, especially around specialisms and specialist professionals * | Director of Human Resources |

| Review of expenses policy | Director of Human Resources |

| Management Board operating framework & scheme of delegation * | Director of Business Strategy |

| Performance against business group business plans * | Director of Business Performance |

| Organisational learning * | All Management Board members |

| Compliance framework * | Director of Resources |

| Review of MPS Environment Strategy and development of Corporate Social Responsibility / Sustainable Development Strategy for 2010-13 * | Director of Resources |

| Service Improvement Plan * | Director of Resources |

| Business charge card | Director of Exchequer Services |

| Pillar Two: Reporting to & involving the MPA & stakeholders | |

| Review of all forms of public engagement and consultation | Deputy Assistant Commissioner Territorial Policing Capability and Review |

| Safer Neighbourhoods panel training and business / youth engagement | Assistant Commissioner Territorial Policing |

| Pillar Three: Standards of behaviour | |

| Enhanced MPA/MPS Fraud and Corruption Awareness Strategy * | Director of Finance Services |

| Introducing the Equality Standard | Director, Diversity and Citizen Focus |

* Part of 2009 MPS Annual Assurance Statement (AAS)

Appendix 3 - update on business charge card

Table 1 below shows the value of Barclaycard expenditure as at 21 May 2010

Table 1 – Value of Barclaycard expenditure at 21 May 2010

| Business Group | Current £ | Overdue | Overdue Total £ | Grand Total £ | |||

|---|---|---|---|---|---|---|---|

| 1 - 30 Days Overdue £ | 31 - 60 Days Overdue £ | 61 - 90 Days Overdue £ | 90 Days + Overdue £ | ||||

| SO | 631,426 | 14,057 | 5,926 | 6,779 | 907 | 27,669 | 659,095 |

| SCD | 68,316 | 1,550 | 4,178 | - | - | 5,728 | 74,044 |

| CO | 30,110 | 5,769 | 1,907 | 717 | 1,000 | 9,393 | 39,503 |

| TP | 12,703 | 325 | 375 | 940 | -379 | 1,261 | 13,964 |

| DOI | 4,670 | 70 | - | - | - | 70 | 4,740 |

| DoR & DCP | 276 | 86 | - | - | - | 86 | 362 |

| HR | - | - | - | - | - | - | - |

| Sub Total | 747,501 | 21,857 | 12,386 | 8,436 | 1,527 | 44,207 | 791,709 |

| Under Inv | - | - | - | - | 10,019 | 10,019 | 10,019 |

| Total | 747,501 | 21,857 | 12,386 | 8,436 | 11,546 | 54,226 | 801,728 |

Table 2 below shows the numbers of cardholders in each category of outstanding returns

Table 2- Number of unreconciled Barclaycard returns as at 21 May 2010

| Business Group | Current | Overdue | Overdue Total | Grand Total | |||

|---|---|---|---|---|---|---|---|

| 1 - 30 Days Overdue | 31 - 60 Days Overdue | 61 - 90 Days Overdue | 90 Days + Overdue | ||||

| SO | 476 | 28 | 7 | 6 | 4 | 39 | 493 |

| SCD | 142 | 4 | 4 | - | - | 8 | 147 |

| CO | 57 | 14 | 2 | 2 | 3 | 19 | 64 |

| TP | 26 | 3 | 1 | 2 | 2 | 7 | 32 |

| DOI | 21 | 1 | - | - | - | 1 | 21 |

| DoR & DCP | 2 | 1 | - | - | - | 1 | 3 |

| HR | - | - | - | - | - | - | - |

| Sub Total | 724 | 51 | 14 | 10 | 9 | 75 | 760 |

| Under Inv | - | - | - | - | 4 | 4 | 4 |

| Total | 724 | 51 | 14 | 10 | 13 | 79 | 764 |

*Thirty-nine cardholders in table 2 above had debt in more than one category.

The average age of the 577 returns processed in April 2010 was 41 days. Against this average, 85% of April processed returns were completed within 60 days of the statement date, i.e. before the end of the one to 30 day overdue period. The reasons for the delay in processing some reconciliations to completion include:

- officers outside the Metropolitan Police District (MPD) and unable to submit claims in a timely manner and

- the time taken to approve and process claims, for example time in transit, return of forms to cardholders to remedy errors, omissions and/or, provide fuller explanations to supervisors.

Under the current scheme, the risk of fraud has been reduced by applying an annual spend limit on each cardholder. Of the 2,351 active cards, 80% (1882) cardholders are on the lowest annual spend limit of £5,000.

Each business group has a documented follow-up processes to ensure that effective supervision is implemented with details of current spend being passed to supervisors who receive a second copy of the statement. The local action plans incorporate a process of escalation of outstanding returns through the cardholder’s line management to the relevant Management Board member.

A regular monthly meeting of business group representatives monitor these processes and procedures and address the long-standing overdue cases and any ‘off policy’ expenditure.

The additional controls put in place on MPS business charge cards include:

- reduced time to account for expenditure;

- greater local control over cards, and

- better local visibility through improved management information.

These controls continue to work well with fewer items not accounted for in time by cardholders and quicker, more effective management intervention / escalation when cardholders do not account for expenditure in accordance with the timetable or the applicable rules and procedures.

There are presently 4 cardholders whose use of the card is under further review for possible abuse of the card.

A further lessons learned review has been completed by the DPS and DARA and as a consequence of that revised procedures will be issued shortly. DARA have commenced the audit of the Barclaycard processes and will be reviewing the revised implementation of the new procedures to ensure compliance.

Send an e-mail linking to this page

Feedback