Contents

Report 8 of the 2 December 2010 meeting of the Corporate Governance Committee, with details of the anti-fraud strategy in the MPA and MPS.

Warning: This is archived material and may be out of date. The Metropolitan Police Authority has been replaced by the Mayor's Office for Policing and Crime (MOPC).

See the MOPC website for further information.

MPA and MPS anti-fraud strategy

Report: 8

Date: 2 December 2010

By: MPA Director of Audit, Risk and Assurance and the MPS Director of Resources on behalf of the Commissioner

Summary

This report informs Members of the anti- fraud activity taking place within the MPA and MPS. The jointly developed anti-fraud strategy provides a strategic framework to manage the risk of internal fraud. The supporting implementation plan sets out future and planned activity. Members are asked to approve the strategy and supporting implementation plan.

A. Recommendation

Members are asked to: Approve the anti-fraud strategy and endorse the planned approach to managing the risk of fraud in the MPA and MPS in 2011 - 2014.

B. Supporting information

1. The MPA has set out its opposition to the loss of public funds allocated for policing London to fraud and corruption in an Anti-Fraud and Good Conduct Policy. This policy forms part of the Standing Orders of the Authority. The policy statement is that:-

The Metropolitan Police Authority is committed to a culture that is one of honesty, integrity and propriety in the holding of public office and the use of public funds. The Authority will not tolerate fraud and corruption in the administration of its responsibilities from inside or outside the Authority.

2. The Audit Commission in September 2009 published a report, Protecting the Public Purse, into the response to fraud in local government. The report identified the following as representative of authorities managing effectively the risks of fraud:-

- Developing a zero-tolerance approach towards fraud.

- Improving governance arrangements including establishing audit committees.

- Adopting good practice in managing the risk of fraud.

- Creating a strong counter-fraud culture and implementing counter fraud policies and procedures.

- Training and supporting specialist staff to prevent and detect fraud.

The Audit Commission is planning to issue a 2010 edition of Protecting the Public Purse.

3. The MPA and MPS have many of the arrangements identified by the Audit Commission already in place, although more remains to be done. The Authority has clearly set the tone in its attitude towards fraud and corruption in the Good Conduct and Anti-Fraud Policy, although more work is needed to embed it across the MPA and MPS.

4. The Authority has had an audit committee in place since its interception, as well as internal audit arrangements including a counter-fraud branch. The MPS has established a Corporate Governance Framework and currently has the Developing Resource Management Programme in progress - an update on these is elsewhere on the agenda for this meeting.

5. Many anti-fraud policies and procedures are already in place to implement good practice across the MPS, for example fraud awareness training for key staff has already been conducted and a further series of events is planned for later this year. Procurement activity in the MPS is a further example of current work in progress.

6. The specialist Counter Fraud Branch (previously known as the Forensic Audit Branch) of DARA has been operational in the MPA and MPS since the Authority was established and being a police authority the necessary expertise in fraud is also available elsewhere in the MPS.

7. Counter fraud activity needs to be dynamic to tackle the fraud risk and in order to address any gaps, work will need to continue. This work will be informed by an Anti-Fraud Strategy. The strategy sets out the activities planned in the current year and for the future.

8. Deriving maximum benefit from the resources allocated to counter fraud work across the MPA and MPS will require that the work is informed by a fraud risk assessment, in order that resources are focused on the highest risk areas.

Anti-Fraud Strategy

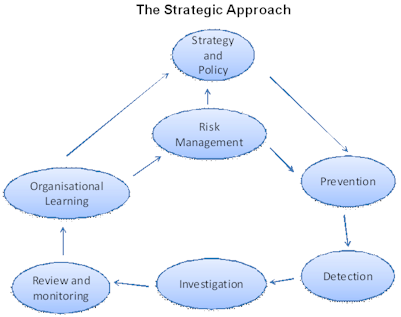

9. An effective anti-fraud strategy requires a range of activities across all areas of the MPA and MPS to manage the risks of internal fraud and corruption. It involves managers and staff working collaboratively to minimise the opportunities for fraudulent behaviour. The Strategy contains seven strands, strategy and policy, risk management, prevention, detection, investigation, review and monitoring and organisational learning. The Strategy is attached to this report as Appendix 1.

10. An implementation plan accompanies the strategy, which assess the current position and identifies those elements requiring further work. An update on progress will be made to each meeting of this Committee.

Future Work

11. Fraud is a dynamic crime and evolves as fraudsters react to counter fraud activity. In order to tackle it effectively the Anti-Fraud Strategy and the Implementation Plan will need to be updated on an annual basis and the outcome of the work will be reported to this Committee.

12. The Counter Fraud Unit of DARA will jointly conduct with the MPS a self-assessment against the standards set out in the Chartered Institute of Public Finance and Accountancy Red Book 2 – Managing the Risk of Fraud. The outcome of this assessment will be reported to the next meeting of this Committee.

13. DARA and the MPS will work together to ensure that the strategy and implementation plan are well publicised.

C. Other organisational and community implications

Equality and Diversity Impact

1. The Anti-Fraud Strategy and the Fraud Risk Assessment do not target individuals and do not contain any profiles for targeting any of the equality strands.

2. Any individual identified as a result of counter fraud activity will be investigated in accordance with the established procedures of the MPA or MPS to ensure that they are dealt with fairly and proportionately.

Consideration of MET Forward

3. The strategy supports the Met People and Met Support strands by minimising the fraudulent diversion of funds way from front line policing. Also Met Specialist by contributing to public confidence in policing.

Financial Implications

4. The Audit Commission report Protecting the Public Purse, highlights authorities are being financially squeezed from all sides and that as a result of the recession fraud is likely to increase as:-

- Economic distress can increase the incentive to commit fraud.

- Controls to prevent and detect fraud can come under pressure as authorities reduce their costs.

- On 20 October 2010 the Government announced the outcome of their Comprehensive Spending Review.

5. Funds lost to fraud and corruption are not available for the policing of London and the arrangements set out in this report seek to minimise such losses.

6. There are no specific financial implications from this report as the cost of the work is contained within existing budgets.

Legal Implications

7. There are none specific to this report.

Environmental Implications

8. There are none specific this report.

Risk Implications

9. The subject of this report is about identifying and tackling the fraud risk faced by the MPA and MPS. Failure to address the risk can, in the event of serious fraud, cause financial, operational and reputational damage to the MPA and MPS.

D. Background papers

- Anti-Fraud and Good Conduct Policy - Part of the Standing Orders of the MPA.

- Audit Commission Report – Protecting the Public Purse (September 2009) – Copies are available from DARA.

E. Contact details

Report author: Ken Gort, MPA Head of Counter Fraud and Nick Rogers, MPS Director of Finance.

For information contact:

MPA general: 020 7202 0202

Media enquiries: 020 7202 0217/18

Appendix 1. Anti- Fraud Strategy and Implementation Plan 2011 – 2014

Introduction

Everyone who serves in the Metropolitan Police Authority (MPA) and Metropolitan Police Service (MPS) must understand and subscribe to our values – professionalism, pride and commitment to the service of London. One aspect of this is that the MPA and MPS will not tolerate fraud and corruption in the conduct of their business.

In addition to causing the financial loss of public funds, fraud is detrimental to the provision of services, the reputation of the MPA and MPS, reduces public confidence and can adversely impact on the delivery of policing priorities.

Definition of Fraud

For the purposes of this strategy, fraud is defined as:

Any instance where the MPA/MPS is the victim or attempted victim of intentional financial irregularity or an illegal act perpetrated by one of its employees, contractors, suppliers or others, regardless of whether or not a loss has been incurred. The definition also covers theft of MPA/MPS funds and assets. Compliance with MPA standing orders (Financial and Contract Regulations) and MPS policies and standard operating procedures is also included.

The term fraud covers dishonest behaviour that ranges from organised systemic attacks against MPS funds to individual acts of dishonesty, including, for example, the over claiming of allowances, overtime and expenses, unauthorised private use of official vehicles and misuse of corporate credit cards.

Aim

Our aim is to minimise opportunities to commit fraud and corruption. This will contribute to preventing the diversion of funds which puts at risk the delivery of Met Forward, the Commissioner’s 5Ps and the annual policing plan.

Strategic Approach

Combating fraud requires a strategic approach to preventing, detecting and investigating the loss of public funds. To tackle harmful fraud threats effectively, officers and staff need to work collaboratively to prevent, deter and detect fraudulent behaviour. An anti-fraud strategy forms part of the governance arrangements of the MPA and MPS and many of the anti-fraud measures are already in place. This strategy provides a framework which will co-ordinate activity to create a hostile environment for fraudsters.

We have grouped our strategy into seven strands which collectively are designed to provide a holistic integrated programme to counter fraud and corruption.

Delivering the Strategy

Each of the seven strands are components that together form a comprehensive strategy to mitigate the fraud risks within the MPA and MPS.

1. Strategies and Policy

High performing public bodies will have a strategic and policy framework for counter fraud and corruption activity linked to organisational objectives that is up to date and regularly reviewed. Our anti-fraud and corruption strategies and policies make it clear to staff at all levels the high standard of integrity expected.

2. Risk Management

Risk management under pins our strategic approach and assists in accurately identifying the fraud risks across the MPA and MPS. The corporate risk management approach will include identifying and evaluating risks around fraud. A specific fraud risk assessment has been completed by the Directorate of Audit, Risk and Assurance. A strategic threat assessment prepared by MPS Directorate of Professional Standards examines threats to the integrity of the MPS.

3. Prevention

Preventing fraud happening in the first place is preferable to dealing with the harmful consequences of failing to do so. Prevention is therefore one of the key strands of our strategy. It is a diverse strand that encompasses activities including the robust vetting of staff, procedure and system design, effective communication and fraud awareness training.

The MPS Resources Directorate under their Developing Resource Management and the MPS Service Improvement Programme aim to improve the control environment including compliance with policy and procedures.

4. Detection

The early detection of any fraud within the MPA and MPS reduces the detrimental impact and demonstrates the commitment to tackling fraud. It acts as a deterrent to would be fraudsters and contributes to developing an anti-fraud culture. The scope of this strand includes the use of audit and inspection, supervision and review and analytical techniques to identify potential fraud and corruption. Well publicised and user-friendly arrangements to facilitate the reporting of wrong-doing (e.g. Right-Line), in which staff have confidence, is also included.

5. Investigation

All reported suspicions of fraud will be investigated irrespective of the source of the information e.g. confidential reporting line and e-mail, pro-active analysis of data, reports from line-managers etc. Effective investigations into suspected fraud will be conducted by appropriately skilled and resourced staff. Documented information is available that sets out the roles and responsibilities of those dealing with suspicions of fraud. The investigations will be undertaken in a fair, consistent, timely and firm manner. As outlined in the MPA Good Conduct and Anti-Fraud Policy in those cases where sufficient evidence is available appropriate action will be taken including; criminal, disciplinary and civil recovery action to recover funds lost to fraud.

6. Review and Monitoring

Measuring the impact of the implementation plan on counter fraud activity will be essential to realising the benefits of the strategic approach. In doing this, we will consider both the quantitative data on fraud cases and detections as well qualitative data to identify any shifts in the levels of fraud awareness amongst MPA and MPS personnel.

We will also benchmark our anti fraud arrangements against other public sector organisations and conduct a self-assessment against recognised best practice to ensure that our approach remains efficient and fit for purpose.

7. Organisational Learning

Lessons learnt from cases will not be confined to those directly affected by the fraud but recorded and made available for the benefit of the whole organisation. Reviews at the conclusion of cases will report not only the systems or supervisory weaknesses that may have allowed the case to occur but also examine if the response to the fraud was appropriate. The MPS Human Resources Directorate is developing mechanisms through their Organisational Learning Forum for capturing and sharing this learning across the MPA and MPS. The implementation of this strategy will link into the developing organisational learning structure. Publicity will be given to suitable proven cases of fraud as a deterrence measure.

Implementation Plan

The attached implementation plan supports the delivery of our strategy. It shows work currently underway and future planned activity. Progress against the implementation plan will be reported quarterly to the MPS Governance Board and the MPA Corporate Governance Committee.

Evaluating Success

This strategy sets out a framework within which the implementation plan will be delivered. We are focussed on delivering an effective and integrated approach to fraud prevention and minimising the opportunity for people to commit fraud against us.

Ultimately success will be judged by:

- The perception by the majority of officers and staff that the MPS and MPA are serious about tackling fraud and corruption and have effective measures in place to combat it

- An increased confidence in reporting suspected wrong-doing and fraud.

- A reduction in fraud

The above will contribute to a strong anti-fraud culture leading to increased public and staff confidence in the leadership and operation of the MPA and MPS.

Supporting material

Send an e-mail linking to this page

Feedback