Contents

Report 5 of the 14 March 2011 meeting of the Resources and Productivity Sub-committee, updates on the status of the previously approved actions in support of the Mayor’s Early Payment to Small and Medium Enterprises (SMEs) Initiative and the current payment profile for such suppliers.

Warning: This is archived material and may be out of date. The Metropolitan Police Authority has been replaced by the Mayor's Office for Policing and Crime (MOPC).

See the MOPC website for further information.

Update on the implementation of early payment initiatives to Small Medium Enterprises

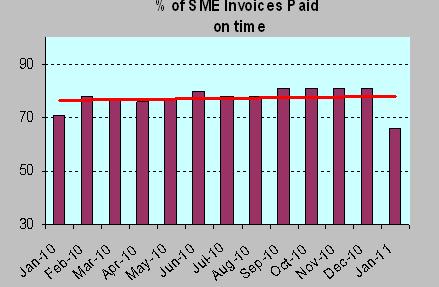

Report: 5

Date: 14 March 2011

By: Director of Resources on behalf of the Commissioner

Summary

This report updates members of the status of the previously approved actions in support of the Mayor’s Early Payment to Small and Medium Enterprises (SMEs) Initiative and the current payment profile for such suppliers.

A. Recommendations

That members

- note the actions taken to date to improve the time to make payment on undisputed invoices to SMEs with the ultimate aim being payment within 10 working days of the receipt of a valid invoice and the current payment profile for SMEs.

B. Supporting information

1. In January 2009 the Finance and Resources Committee approved the report entitled “MPA Commitment to GLA Four Year Responsible Procurement Plan. The Committee approved a series of actions with the aim to pay SMEs earlier than the current nett 30 day payment terms and ultimately for all SMEs to be paid within a 10 working day payment term. In approving these actions, as part of a wider programme of improvement to procurement processes, the Committee was satisfied that these actions supported the principal duties of the Authority.

Payment Performance Information

2. From April 2009 the MPS has used methodology outlined in The Department for Business, Enterprise & Regulatory Reform (BERR) document of the 12 November 2008.

3. The definition for 10-day payment to SMEs defined in the BERR document states that the payment date will be deemed as two days after the date the payment leaves our payment system to clear BACS.

4. The clock starts when the MPS receives a valid and correct invoice, if an invoice is incorrect the clock returns to zero until such time as a correct invoice is received. From April 2009 the MPS has used a sampling exercise to determine an average postage delay to calculate a received date. Prior to April 2009 calculations were based solely on the date stated on the invoice without consideration of postage delays.

5. A summary of data for payments made to SMEs over the last 12 months is set out below:

| Month | Jan- 10 | Feb-10 | Mar-10 | Apr-10 | May-10 | Jun-10 | Jul-10 | Aug-10 | Sep-10 | Oct-10 | Nov-10 | Dec-10 | Jan-11 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % On time | 71 | 78 | 77 | 76 | 77 | 80 | 78 | 78 | 81 | 81 | 81 | 81 | 66 |

| 0- 10 days | 6538 | 7977 | 10814 | 7808 | 7500 | 8936 | 8194 | 7819 | 7427 | 7151 | 10293 | 7996 | 5582 |

| 11-20 days | 796 | 652 | 955 | 1047 | 908 | 902 | 690 | 652 | 526 | 601 | 814 | 775 | 783 |

| 21-30 days | 557 | 312 | 629 | 555 | 419 | 472 | 387 | 452 | 298 | 271 | 416 | 244 | 653 |

| + 30 days | 1273 | 1298 | 1616 | 910 | 940 | 844 | 1263 | 1120 | 916 | 833 | 1043 | 893 | 1390 |

| Total Volume | 9164 | 10239 | 14014 | 10320 | 9767 | 11154 | 10534 | 10043 | 9167 | 8856 | 12566 | 9908 | 8408 |

6. For comparative purposes the GLA Group performance based on the latest figures available (Dec 2010) is set out below.

GLA: 86.9%

TfL: 87.7%

LFB: 92.2%

LDA: 88.4%

MPS: 80.7%

Number of invoices typically processed per month - ALL suppliers

GLA: 830

TfL: 25,000

LFB: 4,000

LDA: 750

MPS: 30,000

Payments Developments - New for 2011

7. The number of payments made to SMEs in January 2011 dropped from 81% to 66%. The new MPS payments system was installed on 13 December 2010. Although early indications regarding the functionality of the system are positive Exchequer Services have encountered the following problems post implementation which has led to the reduction in the payment on time figure.

- A number of small technical problems have been identified. These issues have affected processing speeds and cannot be resolved until end of February 2011 when a programme to upgrade the corporate SAP system is completed

- The loss of 5 experienced Accounts Payable staff in November and December 2010 through promotion and departure. These reductions were not planned to take place until April 2011 to allow for the smooth transition to the new system and to support staff in business groups to use the new system.

- The delays in January receiving invoices due to holidays and bad weather

In order to ensure payments continue to be processed as quickly as possible Exchequer Services have

- implemented a planned overtime programmed funded by the 5 vacancies

- Moved staff from other parts of Exchequer Services and Finance to ensure the deadlines for year end are met

- Completed refresher training for Accounts Payable staff on the new system

- Continued weekly communication to the business groups stressing their role in the payments process

- Looked at savings in staff time resulting from the centralization of large contracts

As a result of the above it is felt that the January 2011 performance figure will improve steadily in February and March. However experience shows that a number of late invoices are presented for payment at year end and it is estimated that performance will not be fully back on track until April.

8. The advantages of the new system once fully implemented are:

- All invoices will be paid via a standard process leading to a reduction in the size of the AP team

- Staff across the MPS will have to make less manual interventions to authorize payments.

- the MPS will be able to claim early payments discounts where appropriate

- An improvement to year end procedures

9. To assist MPS suppliers Procurement Services in conjunction with Exchequer Services have designed externally hosted web-pages which provide guidance on all aspects of conducting business with the MPS. This guidance includes best practice in relation to the design and submission of invoices.

Leading on from this Procurement Services are finalising a ‘No PO No Pay’ policy with the support of Exchequer Services which will allow invoices to be processed only if they quote a valid PO number. This will conclude the Purchase Order (PO) compliance agenda that was started in the MPS in 2010.

C. Other organisational and community implications

Equality and Diversity Impact

1. The implementation of the SME payments initiative can be described as “affirmative” action for a distinct group of suppliers who, it is viewed, can be disadvantaged in the procurement process due to lack of equality. Supporting diversity of ownership in the MPS supply base could provide benefits to Social Enterprises, Black and Minority Ethnic Enterprises, women and disabled owned business.

Consideration of MET Forward

2. Supporting the Mayor’s initiative to help SMEs through improved cash flow and thereby maintaining a diverse supply base for MPS purchasing of goods and services to support policing requirements.

Financial Implications

3. This report sets out the work completed to date to improve the Service’s payment processes within a compliant environment which will make a significant contribution to the Mayor’s objective of making payments to SMEs within 10 working days.

The work implemented to date has been completed within existing resources or as part of a larger programme of work to improve the Service’s procurement processes. As a result of early payment there will be a loss in interest charges or an increased cost of borrowing because cash will be required earlier. It is still difficult at this stage to determine this potential loss as it depends on the level of early payments, cash balances and prevailing interest rates but a best estimate is still considered to be between £35k and £51k per annum in terms of opportunity costs of lost interest receipts.

Legal Implications

4. It is not the intention of the MPS to amend any contract, tender document or purchase order to reflect a 10 working day payment period. The payment terms will only be amended on the MPS system, i.e. the express terms of the MPS will continue to be net 30 days and will outweigh any custom and practice claims of a supplier if, at some point, we revert back to net 30 day payment.

External legal advice was submitted to this Committee and the MPA officers in December 08 and January 09 as part of previous papers on this topic. In summary the legal advice was that under S.111 of the Local Government Act ("LGA") 1972 the MPA was entitled to "do anything (whether or not involving the expenditure, borrowing or lending of money or the acquisition or disposal of any property or right) which is calculated to facilitate, or is conducive or incidental to, the discharge of any of its functions". To fulfill its fiduciary duty under S.111 of the LGA 1972 the MPA has to justify differentiated payment as a course of action which supports its principal obligations, which are to secure the maintenance of an efficient and effective police force (S.6(1) Police Act 1996) and to achieve best value in terms of economy, efficiency and effectiveness (S.3(1) LGA 1999).

The actions approved by this committee in January 2009 were taken following a review of the above external legal advice. The Committee was of the view that the Authority were acting within the acceptable boundaries of the advice.

Environmental Implications

5. There are no environmental implications, however there are positive social and economic impacts as noted in sections 1 and 2.

Risk (including Health and Safety) Implications

6. Please refer to Financial Implications.

D. Background papers

None

E. Contact details

Report authors: Paul Daly, Director of Exchequer Services, MPS

For more information contact:

MPA general: 020 7202 0202

Media enquiries: 020 7202 0217/18

Send an e-mail linking to this page

Feedback