Contents

Report 10 of the 23 Sep 04 meeting of the Corporate Governance Committee and this report confirms the process for reporting risk within the Metropolitan Police Service and the involvement of the Authority’s Corporate Governance Committee in exercising oversight of MPS risk management and corporate risks.

Warning: This is archived material and may be out of date. The Metropolitan Police Authority has been replaced by the Mayor's Office for Policing and Crime (MOPC).

See the MOPC website for further information.

Risk Management Update

Report: 10

Date: 23 September 2004

By: Commissioner

Summary

This report confirms the process for reporting risk within the Metropolitan Police Service and the involvement of the Authority’s Corporate Governance Committee in exercising oversight of MPS risk management and corporate risks.

A. Recommendation

That

- the development of risk management within the MPS including the processes for reporting risk within the Service be noted; and

- the future involvement of this Committee in the oversight of MPS risk management and corporate risks be noted.

B. Supporting information

Background

1. A newly adopted overarching risk management strategy provides a framework for managing risk within the MPA and MPS. The MPA exercises oversight and monitoring of MPS risk management through this Committee and its link to the MPS Corporate Governance Strategic Committee (CGSC). The strategy and implementation programme are attached as annexes ( Appendix 1 and Appendix 2 respectively).

2. The CGSC has a remit to ensure that there is a robust regime of good practice corporate governance within the Service. This includes the establishment and maintenance of a systematic strategy, framework and processes for managing risk, including reporting of risks.

3. OCU risk profiles will feed into Business Group profiles that will in turn feed into the MPS Corporate Risk Profile. The Authority also has a risk profile. Once the new risk management process is in place, and in support of the requirement for the MPA to review internal control and risk management annually, the Corporate Risk Management Group (CRMG) will manage quarterly reporting by the MPS Corporate Governance Strategic Committee (CGSC) to Management Board on the current status of internal control and risk management within the MPS, such reviews to be facilitated by the work programmes of CRMG and MPA Internal Audit. Quarterly reports will be submitted by CGSC to this Committee to enable it to exercise oversight of risk within the Service.

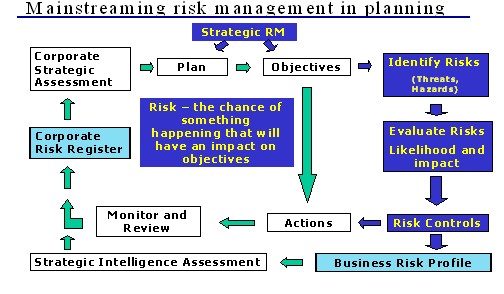

Figure 1

4. Risk management pilots have been undertaken over preceding months. These will ensure that the process to be rolled out Service wide is robust, proportionate and deployable. They have largely been confined to the Deputy Commissioner’s Command. DCC pilots have been undertaken in Directorate of Professional Standards, C3i Programme, and Diversity Directorate. Other pilots involve SCD14 (Covert Operations Unit) and SCD4 (Overseas Policing Unit). CRMG is also working with various SO units. This all follows earlier work with TP. The pilots have provided a useful mix of situations with which to test the efficacy of the risk management process. All pilot activity to date has been successful. The current phase of the roll-out of risk management commenced on 15 September, the final roll-out session being scheduled for 21 October. This will allow a period of learning, supported by CRMG, prior to inclusion of risk profiling in the 2005/06 planning process.

5. A list of examples where adoption of the risk management process has already been seen to add value is attached at Appendix 3.

Risk reporting within the MPS

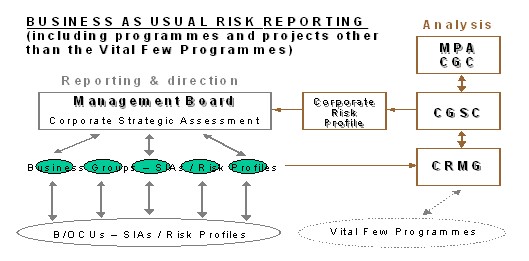

6. Figure 2 is a visual representation of the main process for reporting of risk within the MPS. It involves top/down direction from Management Board and the bottom/up embedding of risk profiling within the NIM Strategic Intelligence Analysis (SIA) process culminating in CRMG facilitated risk input to the MPS Corporate Strategic Assessment. In this way, NIM is enabled to handle business risk in addition to core policing activity risk issues (crime).

Figure 2

N.B. The ‘Vital Few Programmes’ are the seven major change programmes identified by the Change Co-ordination Team as being of critical importance to the MPS.

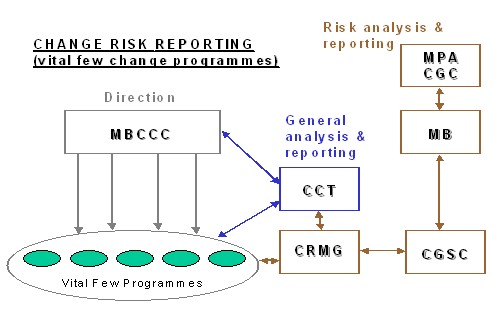

7. The arrangements for reporting of risks associated with MPS Vital Few Programmes (see figure 3) are slightly different to that set out above in view of the involvement of the Change Co-ordination Team.

Figure 3

N.B. The MPS Management Board Change Co-ordination Committee (MBCCC) exercises oversight of the Vital Few Programmes on behalf of the Service.

Monitoring the impact of risk management

8. The risk management strategy requires that a performance management framework be developed to monitor the impact of risk management activities and the success of the Risk Management Strategy itself. Individual indicators will be developed to measure achievement of the aims and objectives.

9. For each risk on the MPA/MPS risk profiles a Key Risk Indicator (KRI) will be used to monitor the effectiveness of risk mitigation activity ensuring that a suitable balance is struck between the efficiency of the risk monitoring process and the extent of the risk exposure in each case. KRIs may be existing or new measures as necessary.

10. Initial proposals for an approach to measurement of the impact of risk management are set out at Appendix 4. These are subject to further consultation.

11. A key element of the measurement proposals is the introduction of a performance indicator around the joint Audit Commission / ALARM risk management survey criteria (as set out in the recent audit overview of MPS risk management arrangements to which report CGC/04/?? refers). A draft template for this proposed indicator is set out at Appendix 5.

C. Equality and diversity implications

1. Risk management has a role to play in improving our position on equality and diversity through an improved focus on the risk of failure to achieve equality and diversity targets and emphasis on continuous improvement.

2. At CRMG’s suggestion, an approach to human rights/diversity impact assessment has been incorporated within the risk management process.

D. Financial implications

1. The programme of work to mainstream risk management is to be funded from existing budgets. The cost of the small central MPS resource engaged on deploying risk management is a trivial percentage of the potential financial impacts of unmanaged risk exposures and can be regarded as an investment in building the future Service.

2. A particular focus for financial savings is insurable risk management. The Director of Risk Management will be ensuring that risk management measures address the need to secure reductions in financial claims and losses and support the achievement of cost-effective insurance arrangements.

E. Background papers

- Management Board reports MB(04)25 and MB(04)57

- Finance Committee report FC22-04

F. Contact details

Report author: Nick Chown, Director of Risk Management

For information contact:

MPA general: 020 7202 0202

Media enquiries: 020 7202 0217/18

Supporting material

- Appendix 1 [PDF]

MPA/MPS Risk Management Strategy - Appendix 2 [PDF]

MPS Corporate Risk Management Programme Phase 1 - Appendix 3 [PDF]

Added Value From Risk Management - Appendix 4 [PDF]

Key Risk Indicator Proposals - Appendix 5 [PDF]

Audit Commission / Alarm Risk Management Survey

Send an e-mail linking to this page

Feedback