Contents

Report 10 of the 2 December 2010 meeting of the Corporate Governance Committee, with a progress update on work areas pertaining to the MPS corporate governance framework.

Warning: This is archived material and may be out of date. The Metropolitan Police Authority has been replaced by the Mayor's Office for Policing and Crime (MOPC).

See the MOPC website for further information.

MPS corporate governance framework update

Report: 10

Date: 2 December 2010

By: Director of Resources on behalf of the Commissioner

Summary

This report provides a progress update on work areas pertaining to the Metropolitan Police Service (MPS) corporate governance framework.

A. Recommendation

That Members note the progress being made across a number of corporate governance work areas.

B. Supporting information

Current corporate governance arrangements

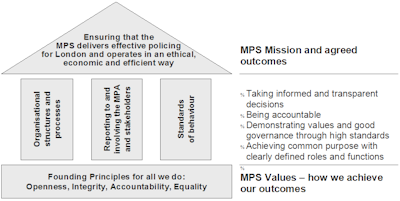

1. The MPS continues its drive to achieve excellence in corporate governance. It uses an established ‘temple’ model of corporate governance, approved by Management Board (see Appendix 1) that reflects current good practice.

2. The MPS corporate governance work programme consists of a number of work streams that have been identified through a gap analysis against elements of the CIPFA/SOLACE framework: “Delivering Good Governance in Local Government” the Interim Guidance Note for Police Authorities & Forces in England and Wales (2007) and significant governance issues included the 2009/10 MPS Annual Assurance Statement. A full list of work streams and the responsible leads is included in Appendix 2. This work programme is managed and monitored through the MPS Governance Board with regular progress updates to this Committee.

3. This is the second quarterly report identifying improvement against the 2009/10 Annual Assurance Statement.

Summary of progress

4. For each work stream, a progress update for quarter 2 is detailed below.

Pillar One: Organisational structures & processes

5. Embedding risk management

- Work to refresh the corporate risk areas, taking into account current changes in circumstances, is well underway. The analysis that underpins the Business Continuity and Health and Safety risks has been reviewed and updated to ensure the control mechanisms in place are fit for purpose. Work to analyse the remaining risks will continue during the next quarter.

- The maturity model has been updated following findings from the pilot and assessments are scheduled to take place in SO, DoI, CO, HR and DPS in the next quarter.

Implementation of Developing Resource Management (DRM) Programme

6. Corporate Real Estate (CRE)

Following agreement of the Corporate Real Estate proposals by MPS Management Board (June 2010) there has been extensive work across the MPS and

with the MPA.

- August saw much preparatory work on CRE communications with support from TP and the DPA, including the development of a strategy, plan, and key messages.

- The updated 2010/11 disposals list was presented to the MPA Estates Panel in September and was agreed by the MPA Finance and Resources Committee in October;

- Proposals for 2011/12 are now in development with MPS Business Group leads.

7. Procurement

Capgemini provided onsite support to this workstream from May to September 2010, delivering five projects: Effective Purchase Order Management; Effective Contract Management, which included the

contract management toolkit; Strategic Procurement Plans; Enhancing Technology; and Capability Enhancement.

8. Source-to-Payment

- Since MPS Governance Board approval in June 2010 this workstream has moved through various security processes including the Enterprise Architecture Board, in collaboration with DoI.

- The project team held a well attended expo for potential suppliers in August 2010, generating interest and stimulating competition. The Invitation to Tender was issued in September and queries have been received from a number of significant providers.

- The project governance structure was agreed by DRM Steering Group in September 2010 and the final project team members are being recruited.

9. SAP Development

Asset Tracking

- The first phase of the Asset Tracking project, which will deliver asset tracking functionality to Uniform Services, Transport Services and Criminal Exhibit Services, is now in its delivery phase.

- The funding request for a feasibility study for the second phase of the Asset Tracking project was supported by DRM Steering Group in September. Phase 2 will provide asset tracking functionality to TP, be a vital enabler of other change projects, e.g. Corporate Real Estate, and deliver significant savings.

- The full go-live date for the Capital Management functionality was 25 October

- Invoice Management is in final stages of delivery, with go-live at the end of November 2010.

SAP Capability

- The SAP Capability Review is now underway following the contract award for external support to PriceWaterhouseCoopers (PWC) in August. The PWC team started onsite in October as part of a 12-week plan to assess our use of SAP Financials and develop a Roadmap to improve MPS use of SAP as an enterprise application.

10. Finance and Resources Modernisation 2

- Following agreement of an initial business case in June 2010, there has been significant progress. The initial project team was recruited and began work in July.

- Full engagement with business groups began in August, including interviews with business managers and lead accountants, and staff workshops with staff at all levels.

11. Service Improvement Plan

The financial position and summary of progress of the key SIP projects formed part of the 22 September Management Board paper on the development

of the Policing London Business Plan 2011 – 14 report.

Exception reporting on the progress of the key SIP projects, to include critical dependencies, formed part of the QMR presented to MPS Management Board in November and to the MPA in December.

12. Partnerships

During the last quarter the Partnership team has worked closely with key internal MPS stakeholders to drive joint working on key deliverables, and engaged

with external stakeholders from the MPA, Home Office, ACPO and the NPIA.

The following milestones have been delivered in the last quarter:

- Implementation of the action plan to strengthen the management of the procurement risk relating to partnerships;

- Initial identification of Partnership issues for the SAP Review;

- Scoping of Partnership inputs into MPS training packages;

- Development of bespoke Partnership Guidance for TP Safer Neighbourhood teams;

- Development of the Partnerships database, including enhanced data collection, and initial analysis to inform a model to baseline significant partnerships and enable the development a risk-weighted approach;

- Review of external stakeholders.

13. Provision of detailed information on emerging market hotspots, especially around specialisms and specialist professionals

- Engagement is underway with all HR Business Partners to identify market pressures in each business group. It is expected that remuneration will be highlighted as a key issue.

14. Review of expenses policy

- Expenses policy guidelines in place and policy expected to be published by end of March 2011.

15. Management Board operating framework & scheme of delegation

The recent paper to MPS Management Board on Corporate Decision Making & Scheme of Delegation was well

received and S&ID continue to provide advice to Business Groups regarding delegated responsibilities.

The Management Board Operating Framework revision is now complete and will be kept under review as part of Business as usual.

16. Organisational Learning (OL)

The first MPS Organisational Learning forum took place in September with representatives from all MPS Business Groups and input from

Organisational Learning practitioners. The forum clarified existing learning functions, helped define cross-Business Group communication and existing Organisational Learning methodology.

Work underway includes:

- The development of a set of learning principles, with a supporting toolkit, to help stimulate pro-active learning;

- The development of processes to coordinate the MPS response to external recommendations to ensure that thematic links can be identified and addressed;

- The development of a series of key projects, which include MPS business group performance measures; the use of ICT to share learning; and a communication strategy;

- A defined HR process for continuous improvement, which proposes a single process for capturing, analysing and sharing learning generated from all future HR functions (including Business Partnerships, Operational Support, Expert Services etc) in response to the THR programme

- A process to align organisational learning themes with future training and development planning

The Head of Organisational Learning will report to the Olympic Strategic Coordination Meeting Legacy Committee on the processes to capture and act upon learning from the Olympics 2012. He will also be a key member of the recently formulated ‘Professionalism Steering Committee’.

17. Compliance Framework

Work focused on finalising the Anti-Fraud Strategy and Implementation Plan. Further information is provided in paragraph 25.

18. Review of MPS Environment Strategy and development of Corporate Social Responsibility (CSR) / Sustainable Development Strategy for 2010-13

- The results of the MPIC environmental waste audits have been used to raise awareness among employees and poor performing sites have been targeted with a reminder of how to segregate waste.

- Mandatory Waste Management training around legislation, compliance and the Waste and Recycling SOP has been delivered to Band D Assistant Resources Manager and Band E Resources Officers.

- Estimated savings from the MPS Resources Swap Shop have exceeded £15,000 to date.

- A recycling scheme was implemented at the Notting Hill Carnival in preparation for future operational events (including the 2012 Olympics).

- The new carbon dioxide emissions reduction target for the period 2010-2013 is a further 15% above the 2005-2010 target, which is equivalent to a reduction of 22% from the 2005/06 baseline.

- 60 members of staff have been recruited as a result of the environmental awareness champions scheme with training delivered to 43 so far.

- The MPS Environment Team hosted and chaired the most recent National Police Environmental Advisory Group (NPEAG) meeting. Twenty three of the UK police forces were in attendance to discuss topics including the CRC Energy Efficiency Scheme, waste management compliance and biodiversity within the police estate.

- The CSR Strategy was taken to MPA CEP and noted by the MPA. The document has been designed and is in the final stages of internal review.

19. Business Charge Card

Barclaycards were introduced as the new business charge card in May 2008, with tighter criteria for the cardholder to account for their expenditure

(within 30 days) and there have been a number of reviews and process improvements since.

The most recent review by DARA is in progress and the Service is considering the policy and process changes required to respond to the interim audit findings and changes in business needs. See Appendix 3 for the value and volume of unreconciled expenditure returns as at 31 October 2010 and the numbers of cardholders in the scheme.

Pillar Two: Reporting to & involving the MPA & stakeholders

20. Review of all forms of public engagement and consultation

The joint MPA/MPS Community Engagement Commitment was approved by the MPA at its Full Authority meeting on 22

July 2010. A draft action plan was presented to the MPS Confidence and Satisfaction Board.

Final agreement on the MPS Action plan awaits results from the CSR and will need to link with work being undertaken as part of the TP Development Programme. Following MPS approval, the action plan is due to be presented to the MPA CEP Committee in January 2011.

Safer Neighbourhoods panel training and business/youth engagement

21. Business Engagement

- Further scoping meetings with Police and partners will be taking place over the next month.

- The central unit are continuing to link in with HMIC and NPIA to identify best practice from forces around the country, and looking at Business engagement strategies from BCUs and Town Centre Teams.

- A draft toolkit around business engagement for police and partners will be in place by the middle of December 2010

22. Youth Survey

A Halloween survey targeted at all sections of the community has been planned for November with publication of the results expected by the end of

December.

23. Youth Strategy - Youth Engagement

- In partnership with London Active Communities (LAC) and organisations from the sporting world the MPS supports sporting initiatives for young people in London, including Kickz (football) and Hitz (rugby). Currently work is focused on expanding Hoopz, the basketball equivalent;

- Growing Against Gangs is rolling out across Lambeth, with pilot sessions being planned for 5 other boroughs;

- A single Youth Strategy Board, to be led by Commander Rodhouse, is currently being developed and will utilise the Youth Reference Network and local Youth Panels to encourage young people to become part of youth engagement initiatives.

24. Town Centre Programme

- In October the programme team started modelling a National Intelligence Model (NIM) based analytical tool to determine the interrelationship between victim, offender, location profiling and the numbers of town centre officers necessary to address Total Notifiable Offences (TNO’s) and anti-social behaviour. The results will inform the proposal to provide bespoke patrol hours targets to meet demand.

- Best practice forums will be established in advance of a Special Interest Group to ensure the proper identification and communication of town centre policing best practice.

- Safer Neighbourhoods and PlanWeb crime mapping training will be delivered to Town Centre officers during the next quarter

Pillar Three: Standards of behaviour

25. Enhanced MPA / MPS Fraud and Corruption Awareness Strategy

The joint MPA / MPS Anti-Fraud Strategy and Implementation Plan, which was developed in consultation with key

MPS stakeholders, will be presented to MPS Governance Board in November and MPA Corporate Governance Committee in December for approval.

26. Introducing the Equality Standard

- All Borough and Business Group returns have been sent back to DCFD and centrally reviewed. A schedule has been produced for feedback to (B)OCUs and, in partnership with the MPA, the Community Review Group will also act as part of the verification process

- A document has been compiled from the Borough feedback, including their gap analysis information, which will form part of an overall report on good practice and learning for Area Commanders.

- The Job and DCFD newsletter, Diversity Space, has published articles on the progress and findings on the ESPS.

C. Other organisational and community implications

Equality and Diversity Impact

1. The model of corporate governance set out in this report is based on the principles of openness; integrity; accountability and equality. The development of the framework therefore should have a positive race and diversity impact by ensuring that these principles inform the way in which MPS operates. Furthermore, improved communication of the corporate governance framework aims to help staff understand how to apply these principles in their day-to-day work.

Consideration of MET Forward

2. This report provides assurance that the MPS is improving the governance infrastructure of the MPS to ensure better value for money when fighting crime.

Financial Implications

3. All costs associated with the work streams identified in this report will be met from existing MPS budgets.

Legal Implications

4. The MPA are under a statutory duty to prepare and publish an Annual Governance Statement (AGS), under regulation 4 (2) of the Accounts & Audit Regulations 2003, as amended by the Accounts & Audit (Amendment) (England) Regulations 2006. The AGS is a general certification about governance issues, which is the primary responsibility of the MPA as police authority.

5. In order that the MPA can discharge its statutory duty referred to in paragraph 1 above, the MPS provides its certification to the MPA by submitting an Annual Assurance Statement (AAS), as recommended by CIPFA / SOLACE guidance “Delivering Good Governance in Local Government-Interim Guidance Note for Police Authorities and Forces in England and Wales (2007”) (“The Guidance”), which demonstrates how aspects of governance have been implemented within the police force.

6. The Corporate Governance Framework provides the supporting information which evidences that the MPS will ensure it has robust systems in place that demonstrate it is adhering to the strategic direction set by the MPA, and is delivering good governance through the delivery of many operational and financial aspects within a delegated framework, in accordance with Guidance and best practice.

7. Compliance with the Corporate Framework will also assist in raising standards, reduce risk of legal challenge and build public confidence by ensuring the MPS operates in a transparent manner.

Environmental Implications

8. The work streams identified have varying levels of environmental impact / benefits.

Risk Implications

9. The work streams in this report are key activity areas in risk area 1 of the corporate risk register “need to manage corporate governance effectively”. Improvement in these work areas continues to reduce the risk of a significant governance failure.

D. Background papers

- Appendix 1 - The MPS Corporate Governance Model

- Appendix 2 - MPS Corporate Governance Work Streams

- Appendix 3 - Business Charge Card Update

E. Contact details

Report author: Nicky Harris, Strategy and Improvement Department

For information contact:

MPA general: 020 7202 0202

Media enquiries: 020 7202 0217/18

Glossary of Terms

- CIPFA

- Chartered Institute of Public Finance and Accounting

- CRE

- Corporate Real Estate

- DCFD

- MPS Diversity and Citizen Focus Directorate

- DRM

- Developing Resource Management

- PWC

- PriceWaterhouseCoopers

- NIM

- National Intelligence Model

- SIP

- Service Improvement Plan

- SOLACE

- Society of Local Authority Chief Executives

Appendix 1 - THE MPS Corporate Governance Model

Appendix 2 - MPS Corporate governance work streams

| Work stream | Lead |

|---|---|

| Pillar One: Organisational structures & processes | |

| Embedding risk management * | Director of Business Performance |

| Implementation of Developing Resource Management Programme * | Director of Resources |

| Partnerships * | Director of Resources |

| Provision of detailed information on emerging market hotspots, especially around specialisms and specialist professionals * | Director of Human Resources |

| Review of expenses policy | Director of Human Resources |

| Management Board operating framework & scheme of delegation * | Director of Business Strategy |

| Performance against business group business plans * | Director of Business Performance |

| Organisational learning * | All Management Board members |

| Compliance framework * | Director of Resources |

| Review of MPS Environment Strategy and development of Corporate Social Responsibility / Sustainable Development Strategy for 2010-13 * | Director of Resources |

| Service Improvement Plan * | Director of Resources |

| Business charge card | Director of Exchequer Services |

| Pillar Two: Reporting to & involving the MPA & stakeholders | |

| Review of all forms of public engagement and consultation | Deputy Assistant Commissioner Territorial Policing Capability and Review |

| Safer Neighbourhoods panel training and business / youth engagement | Assistant Commissioner Territorial Policing |

| Pillar Three: Standards of behaviour | |

| Enhanced MPA/MPS Fraud and Corruption Awareness Strategy * | Director of Finance Services |

| Introducing the Equality Standard | Director, Diversity and Citizen Focus |

* Part of 2009/10 MPS Annual Assurance Statement (AAS)

Appendix 3 - Business Charge Card Update

Table 1 below shows the value of outstanding returns by business group using the current criteria where the cardholders only have 30 days to reconcile their cards with table 2 showing the number of cardholders in each category.

Table 1 - Value of Aged outstanding Barclaycard returns as at 31 Oct 2010

| Bus. Group | Current £ | Overdue | Overdue Total £ | Grand Total £ | |||

|---|---|---|---|---|---|---|---|

| 1 - 30 Days Overdue £ | 31 - 60 Days Overdue £ | 61 - 90 Days Overdue £ | 90 Days + Overdue £ | ||||

| SO | 356,379 | 122,005 | 52,292 | 8,980 | 4,121 | 187,398 | 543,777 |

| SCD | 31,071 | 3,532 | 5,286 | 617 | 1,020 | 10,455 | 41,526 |

| CO | 14,554 | 3,823 | 6,974 | 2,451 | 4,261 | 17,509 | 32,063 |

| TP | 4,427 | 705 | 1,489 | - | 39 | 2,233 | 6,660 |

| DOI | 3,213 | 223 | - | - | - | 223 | 3,436 |

| DCP & DoR | 542 | 507 | 592 | 399 | 299 | 1,797 | 2,339 |

| HR | 102 | - | - | - | - | - | 102 |

| Sub Total | 410,288 | 130,795 | 66,633 | 12,447 | 9,740 | 219,615 | 629,903 |

| Under Inv | - | - | - | - | 8,190 | 8,190 | 8,190 |

| Grand Total | 410,288 | 130,795 | 66,633 | 12,447 | 17,930 | 227,805 | 638,093 |

Table 2 - Number of Aged outstanding Barclaycard returns as at 31 Oct 2010

| Bus. Group | Current No. | Overdue | Overdue Total No. | Grand Total No. | |||

|---|---|---|---|---|---|---|---|

| 1 - 30 Days Overdue No. | 31 - 60 Days Overdue No. | 61 - 90 Days Overdue No. | 90 Days + Overdue No. | ||||

| SO | 451 | 137 | 47 | 8 | 8 | 176 | 483 |

| SCD | 92 | 20 | 11 | 3 | 6 | 36 | 112 |

| CO | 50 | 22 | 13 | 4 | 11 | 38 | 71 |

| TP | 20 | 6 | 3 | - | 1 | 9 | 24 |

| DOI | 14 | 3 | - | - | - | 3 | 16 |

| DCP & DoR | 6 | 4 | 1 | 1 | 2 | 6 | 12 |

| HR | 1 | - | - | - | - | - | 1 |

| Sub Total | 634 | 192 | 75 | 16 | 28 | 268 | 719 |

| Under Inv | - | - | - | - | 2 | 2 | 2 |

| Grand Total | 634 | 192 | 75 | 16 | 30 | 270 | 721 |

NB: 183 Cardholders had outstanding returns in both current and overdue categories and 43 cardholders had outstanding returns in more than one category of overdue returns

There are 2,368 cardholders in the current scheme. The risk of fraud has been reduced by applying an annual spend limit on each cardholder. Of the issued cards, 80% (1,889) cardholders are on the lowest annual spend limit of £5,000.

Send an e-mail linking to this page

Feedback