Contents

Report 4 of the 3 December 2009 meeting of the Resources and Productivity Sub-committee, with details of early payments to small and medium enterprises.

Warning: This is archived material and may be out of date. The Metropolitan Police Authority has been replaced by the Mayor's Office for Policing and Crime (MOPC).

See the MOPC website for further information.

Update on the implementation of early payment initiatives to small and medium enterprises (SMEs)

Report: 4

Date: 3 December 2009

By: Director of Resources on behalf of the Commissioner

Summary

This report updates members of the status of the previously approved actions in support of the Mayor’s Early Payment to Small and Medium Enterprises (SMEs) Initiative and the current payment profile for such suppliers.

A. Recommendations

That

- Members note the actions taken to date to improve the time to make payment on undisputed invoices to SMEs with the ultimate aim being payment within 10 working days of the receipt of a valid invoice and the current payment profile for SMEs.

B. Supporting information

1. In January 2009 the Finance and Resources Committee approved the report entitled “MPA Commitment to GLA Four Year Responsible Procurement Plan. The Committee approved a series of actions with the aim to pay SMEs earlier than the current nett 30 day payment terms and ultimately for all SMEs to be paid within a 10 working day payment term. In approving these actions, as part of a wider programme of improvement to procurement processes, the Committee was satisfied that these actions supported the principal duties of the Authority.

Payment Performance Information

2. The performance data prior to April 2009 was restricted to the data available for extraction from the MPS financial SAP system using standard reports. [1]

3. From April 2009 the MPS has used methodology outlined in The Department for Business, Enterprise & Regulatory Reform (BERR) document of the 12th November 2008.

4. The definition for 10-day payment to SMEs defined in the BERR document states that the payment date will be deemed as two days after the date the payment leaves our payment system to clear BACS.

5. The clock starts when the MPS receives a valid and correct invoice, if an invoice is incorrect the clock returns to zero until such time as a correct invoice is received. From April 2009 the MPS has used a sampling exercise to determine an average postage delay to calculate a received date. Prior to April 2009 calculations were based solely on the date stated on the invoice without consideration of postage delays.

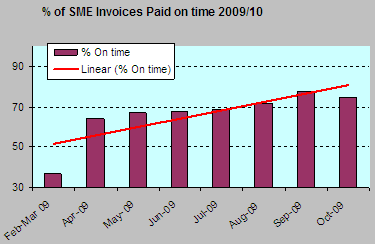

6. A summary of data for payments made since February 2009 is set out below:

| 2009/10 Month | Feb-Mar | Apr | May | Jun |

|---|---|---|---|---|

| % On time | 37 | 64 | 67 | 68 |

| Paid within 10 days | 8238 | 7874 | 6683 | 9019 |

| Paid within 11-20 days | 4269 | 2023 | 1452 | 2058 |

| Paid within 21-30 days | 6885 | 1055 | 753 | 910 |

| Paid after 30 days | 2626 | 1292 | 1035 | 1363 |

| Total Volume | 22018 | 12244 | 9923 | 13350 |

| Jul | Aug | Sep | Oct | |

| % On time | 69 | 72 | 78 | *75 |

| Paid within 10 days | 8153 | 7946 | 7935 | 8935 |

| Paid within 11-20 days | 1525 | 1529 | 1030 | 1253 |

| Paid within 21-30 days | 938 | 514 | 440 | 484 |

| Paid after 30 days | 1167 | 1117 | 836 | 1235 |

| Total Volume | 11783 | 11106 | 10241 | 11907 |

*The effect of the postal strikes causing delays in receiving invoices and the erratic nature of those delays will have affected our performance in October.

7. For performance purposes the GLA Group performance from the Mayor’s 3rd Quarter (September 2009) update is set out below:

- GLA: 72.4% (down from 83.5% - due to incorrect processing in some departments)

- TfL: 77.9% (down from 89% - due to errors in earlier figures, previous quarter adjusted to 77.4%)

- LFB: 86.9% up from 82.4%

- LDA: 83.2% up from 69.2%

- MPS: 77.5% up from 67.6%

Purchase to Pay (P2P) Developments

8. Since August, 80% compliance has been achieved using the correct Routes to Purchase (RTP), meaning the MPS has much greater visibility on purchase orders being made across the organisation.

9. 90% of TP purchases are now being paid for via a compliant RTP which is an impressive 40% improvement within the last 4 months.

10. As at November 2009, four of Catering’s top seven suppliers have been brought onto a limit order RTP system. The fifth is expected to be onboard by December 2009. Other suppliers will come on board in a phased manner.

11. A contracts comparison report is now available that helps to provide an effective overview of contracts in SAP ERP and ProContract.

12. The MPS has recently acquired the technical capability to import supplier invoices in the form of an Excel spreadsheet directly into SAP. This means that invoices from suppliers who can supply files in this format can be processed more efficiently.

13. A pilot is to be run with a trusted MPS supplier to trial the new process, with a view to potentially employing a similar system for the new master vendor for temporary labour.

Exchequer Services Accounts Payable Customer Survey

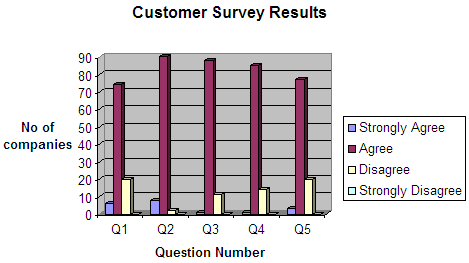

14 In October 2009 as part of National Customer Services Week, Accounts Payable Staff surveyed 100 SMEs to assess the changes made in the way the MPS pays these organisations. The sample of 100 suppliers was taken from analysing payment data to those SMEs who had at least 10 invoices paid in the period July - September 2009.

15. The surveyed organisations were asked “To what extent do you agree/disagree with the following statements?”

- The MPS pay invoices on time

- MPS Accounts Payable Staff are professional and polite when dealing with invoice queries

- Invoice queries are resolved to a satisfactory standard

- Invoice queries are resolved within an acceptable time period

- The performance of the MPS’ in relation to the payment of invoices has improved sine the change of postal address to PO BOX 63787.

16. Overall the results were extremely positive with the majority of companies agreeing that the MPS pay invoices on time and that the Service is of an acceptable standard.

17. As well as asking the above five questions the Companies were also given the opportunity to provide any other view points that they felt strongly about. The survey provided 22 additional responses of which common answers consisted of comments regarding our good service and improvement, which has been made. The other prominent response was the difficulty sometimes encountered chasing orderers.

18. The performance of the Accounts Payable Team in respect of payments made to SMEs also contributed to the MPS receiving the Gold Award for the Policy, Strategy and Communications category at the Mayor of London’s Green Procurement Code 2009 awards.

C. Race and equality impact

1. The implementation of the SME payments initiative can be described as “affirmative” action for a distinct group of suppliers who, it is viewed, can be disadvantaged in the procurement process due to lack of equality. Supporting diversity of ownership in the MPS supply base could provide benefits to Social Enterprises, Black and Minority Ethnic Enterprises, women and disabled owned business.

D. Financial implications

1. This report sets out the work completed to date to improve the Service’s payment processes within a compliant environment which will make a significant contribution to the Mayor’s objective of making payments to SMEs within 10 working days.

2. The work implemented to date has been completed within existing resources and as part of a larger programme of work to improve the Service’s procurement processes. There will, however, be a potential loss in interest charges on early payments. It is still difficult at this stage to determine this potential loss as it depends on the level of early payments and prevailing interest rates but a best estimate is still considered to be between £50k and £100k in terms of opportunity costs

E. Legal implications

1. It is not the intention of the MPS to amend any contract, tender document or purchase order to reflect a 10 working day payment period. The payment terms will only be amended on the MPS system, i.e. the express terms of the MPS will continue to be net 30 days and will outweigh any custom and practice claims of a supplier if, at some point, we revert back to net 30 day payment.

2. External legal advice was submitted to this Committee and the MPA Officers in December 08 and January 09 as part of previous papers on this topic. In summary the legal advice was that under S.111 of the Local Government Act ("LGA") 1972 the MPA was entitled to "do anything (whether or not involving the expenditure, borrowing or lending of money or the acquisition or disposal of any property or right) which is calculated to facilitate, or is conducive or incidental to, the discharge of any of its functions". To fulfill its fiduciary duty under S.111 of the LGA 1972 the MPA has to justify differentiated payment as a course of action which supports its principal obligations, which are to secure the maintenance of an efficient and effective police force (S.6(1) Police Act 1996) and to achieve best value in terms of economy, efficiency and effectiveness (S.3(1) LGA 1999).

3. The actions approved by this committee in January 2009 were taken following a review of the above external legal advice. The Committee was of the view that the Authority were acting within the acceptable boundaries of the advice.

F. Background papers

None

G. Contact details

Report authors: Paul Daly, Director of Exchequer Services, MPS

For more information contact:

MPA general: 020 7202 0202

Media enquiries: 020 7202 0217/18

Footnotes

1. Date calculated as period between the date of the invoice (used for tax purposes) and date on which a BACS payment leaves the MPS. For note the MPS creates its own invoices for interpreters based on a received claim through the MPS Fox Pro system. In this case the date such an invoice is raised counts as the commencement date for measuring purposes. [Back]

Send an e-mail linking to this page

Feedback