Contents

Report 6 of the 13 September 2010 meeting of the Resources and Productivity Sub-committee, updates on Early Payment to Small and Medium Enterprises (SMEs) Initiative and the current payment profile for such suppliers.

Warning: This is archived material and may be out of date. The Metropolitan Police Authority has been replaced by the Mayor's Office for Policing and Crime (MOPC).

See the MOPC website for further information.

Update on the implementation of early payment initiatives to Small and Medium Enterprises

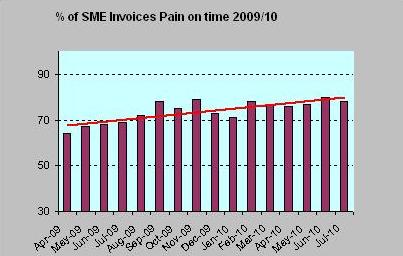

Report: 6

Date: 13 September 2010

By: Director of Resources on behalf of the Commissioner

Summary

This report updates members of the status of the previously approved actions in support of the Mayor’s Early Payment to Small and Medium Enterprises (SMEs) Initiative and the current payment profile for such suppliers.

A. Recommendations

That Members

- Members note the actions taken to date to improve the time to make payment on undisputed invoices to SMEs with the ultimate aim being payment within 10 working days of the receipt of a valid invoice and the current payment profile for SMEs.

B. Supporting information

1. In January 2009 the Finance and Resources Committee approved the report entitled “MPA Commitment to GLA Four Year Responsible Procurement Plan. The Committee approved a series of actions with the aim to pay SMEs earlier than the current nett 30 day payment terms and ultimately for all SMEs to be paid within a 10 working day payment term. In approving these actions, as part of a wider programme of improvement to procurement processes, the Committee was satisfied that these actions supported the principal duties of the Authority.

Payment Performance Information

2. From April 2009 the MPS has used methodology outlined in The Department for Business, Enterprise & Regulatory Reform (BERR) document of the 12th November 2008.

3. The definition for 10-day payment to SMEs defined in the BERR document states that the payment date will be deemed as two days after the date the payment leaves our payment system to clear BACS.

4. The clock starts when the MPS receives a valid and correct invoice, if an invoice is incorrect the clock returns to zero until such time as a correct invoice is received. From April 2009 the MPS has used a sampling exercise to determine an average postage delay to calculate a received date. Prior to April 2009 calculations were based solely on the date stated on the invoice without consideration of postage delays.

5. A summary of data for payments made to SMEs since April 2009 is set out below.

| 2009-11 Month | Apr-09 | May-09 | Jun-09 | Jul-09 | Aug-09 | Sep-09 | Oct-09 | Nov-09 | Dec-09 | Jan-10 | Feb-10 | Mar-10 | Apr-10 | May-10 | Jun-10 | Jul-10 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % On time | 64 | 67 | 68 | 69 | 72 | 78 | 75 | 79 | 73 | 71 | 78 | 77 | 76 | 77 | 80 | 78 |

| 0-10 days | 7874 | 6683 | 9019 | 8153 | 7946 | 7935 | 8935 | 8595 | 7948 | 6538 | 7977 | 10814 | 7808 | 7500 | 8936 | 8194 |

| 11-20 days | 2023 | 1452 | 2058 | 1525 | 1529 | 1030 | 1253 | 802 | 1102 | 796 | 652 | 955 | 1047 | 908 | 902 | 690 |

| 21-30 days | 1055 | 753 | 910 | 938 | 514 | 440 | 484 | 453 | 569 | 557 | 312 | 629 | 555 | 419 | 472 | 387 |

| + 30 days | 1292 | 1035 | 1363 | 1167 | 1117 | 836 | 1235 | 966 | 1246 | 1273 | 1298 | 1616 | 910 | 940 | 844 | 1263 |

| Total Volume | 12244 | 9923 | 13350 | 11783 | 11106 | 10241 | 11907 | 10816 | 10865 | 9164 | 10239 | 14014 | 10320 | 9767 | 11154 | 10534 |

6. For comparative purposes the GLA Group performance based on the latest figures available (July 2010) is set out below.

GLA: 90.1%

TfL: 85.9%

LFB: 88.6%

LDA: 82.53%

MPS: 77.79%

Number of invoices typically processed per month - ALL suppliers

GLA: 830

TfL: 25,000

LFB: 4,000

LDA: 750

MPS: 30,000

Payments developments - New for 2010

7. Exchequer Services has commenced the implementation phase of the project to update the MPS invoice management system. This project is due to be completed by December 2010 and will provide a single more efficient payments system for the 30,000 invoices received each month by the MPS.

8. Since the last SME report presented in June 2010, Exchequer Services has held a number of constructive meetings with our Department of Information, Catering Services and Central Operations. Reviews of payment processes have been completed and improvement plans agreed.

9. Exchequer Services together with Procurement Services has scheduled a further series of workshops for Finance and Resource Managers. These workshops will focus on the key compliance issues in the purchase to payment process; the use of purchase orders, the timely approval of invoices and the maintenance or creation of new vendor.

C. Other organisational and community implications

Equality and diversity impact

1. The implementation of the SME payments initiative can be described as “affirmative” action for a distinct group of suppliers who, it is viewed, can be disadvantaged in the procurement process due to lack of equality. Supporting diversity of ownership in the MPS supply base could provide benefits to Social Enterprises, Black and Minority Ethnic Enterprises, women and disabled owned business.

Consideration of MET Forward

2. Supporting the Mayor’s initiative to help SMEs through improved cash flow and thereby maintaining a diverse supply base for MPS purchasing of goods and services to support policing requirements.

Financial implications

3. This report sets out the work completed to date to improve the Service’s payment processes within a compliant environment which will make a significant contribution to the Mayor’s objective of making payments to SMEs within 10 working days.

The work implemented to date has been completed within existing resources and as part of a larger programme of work to improve the Service’s procurement processes. There will, however, be a potential loss in interest charges on early payments. It is still difficult at this stage to determine this potential loss as it depends on the level of early payments and prevailing interest rates but a best estimate is still considered to be between £50k and £100k in terms of opportunity costs

Legal implications

4. It is not the intention of the MPS to amend any contract, tender document or purchase order to reflect a 10 working day payment period. The payment terms will only be amended on the MPS system, i.e. the express terms of the MPS will continue to be net 30 days and will outweigh any custom and practice claims of a supplier if, at some point, we revert back to net 30 day payment.

External legal advice was submitted to this Committee and the MPA Officers in December 08 and January 09 as part of previous papers on this topic. In summary the legal advice was that under S.111 of the Local Government Act ("LGA") 1972 the MPA was entitled to "do anything (whether or not involving the expenditure, borrowing or lending of money or the acquisition or disposal of any property or right) which is calculated to facilitate, or is conducive or incidental to, the discharge of any of its functions". To fulfil its fiduciary duty under S.111 of the LGA 1972 the MPA has to justify differentiated payment as a course of action which supports its principal obligations, which are to secure the maintenance of an efficient and effective police force (S.6(1) Police Act 1996) and to achieve best value in terms of economy, efficiency and effectiveness (S.3(1) LGA 1999).

The actions approved by this committee in January 2009 were taken following a review of the above external legal advice. The Committee was of the view that the Authority were acting within the acceptable boundaries of the advice.

Environmental implications

5. There are no environmental implications, however there are positive social and economic impacts as noted in sections 1 and 2.

Risk implications

6. Please refer to Financial Implications.

D. Background papers

- None

E. Contact details

Report authors: Paul Daly, Director of Exchequer Services, MPS

For more information contact:

MPA general: 020 7202 0202

Media enquiries: 020 7202 0217/18

Send an e-mail linking to this page

Feedback